安联投资全球首席执行官Tobias C. Pross:私募市场的新趋势和新模式

全球财富管理论坛2023年会近日在北京隆重召开。本次年会以“高水平开放应对全球变局”为主题,邀请国内外政府及监管部门负责人、国际组织代表、金融机构领袖、专家学者及行业机构代表,聚焦当前全球经济金融领域的热点议题及机遇挑战,展开深入探讨,分享真知灼见,展望前沿趋势,为经济金融领域的开放、合作及高质量发展建言献策。安联投资全球首席执行官Tobias C. Pross出席并在“资产管理业再定义:新趋势与新格局”高峰论坛上作主旨发言。

Tobias C. Pross就资产管理业的未来发展趋势进行了深入探讨。私募市场正逐渐成为全球投资者关注的焦点,与公募市场形成互补关系。安联在私募市场上表现出色,特别在另类投资和房地产投资领域具有丰富经验。私募公司的规模远大于公募公司,它们能够降低短期波动性,以长期的投资视角发展。投资者应在实体资产上进行多元化配置,并综合考虑风险回报和现金流管理。在通胀风险上升的背景下,他预测美联储将采取措施降低通胀。反全球化浪潮和事件对全球资本市场产生冲击,投资者需关注其对市场的影响。同时,2023年私募市场,特别是基础设施项目将迎来大量机会。中国市场的跟投机会将对可持续未来发展起到很大助力。此外,安联将继续关注ESG因素,推动可持续发展,为投资者提供长期稳定回报的投资机会。传统的美国市场业务模式正逐渐向私人资本主导的模式转型。投资者越来越富有创意,开始寻求从长期投资者那里获得资金。安联计划将更多资金投入亚洲市场,特别关注中国市场,助力养老金改革等方面的发展。

一、全球资产管理行业新趋势和新模式

在资产管理行业的新趋势和新模式中,近年来,一个特别的趋势越来越得到全球投资者的关注——私募市场。

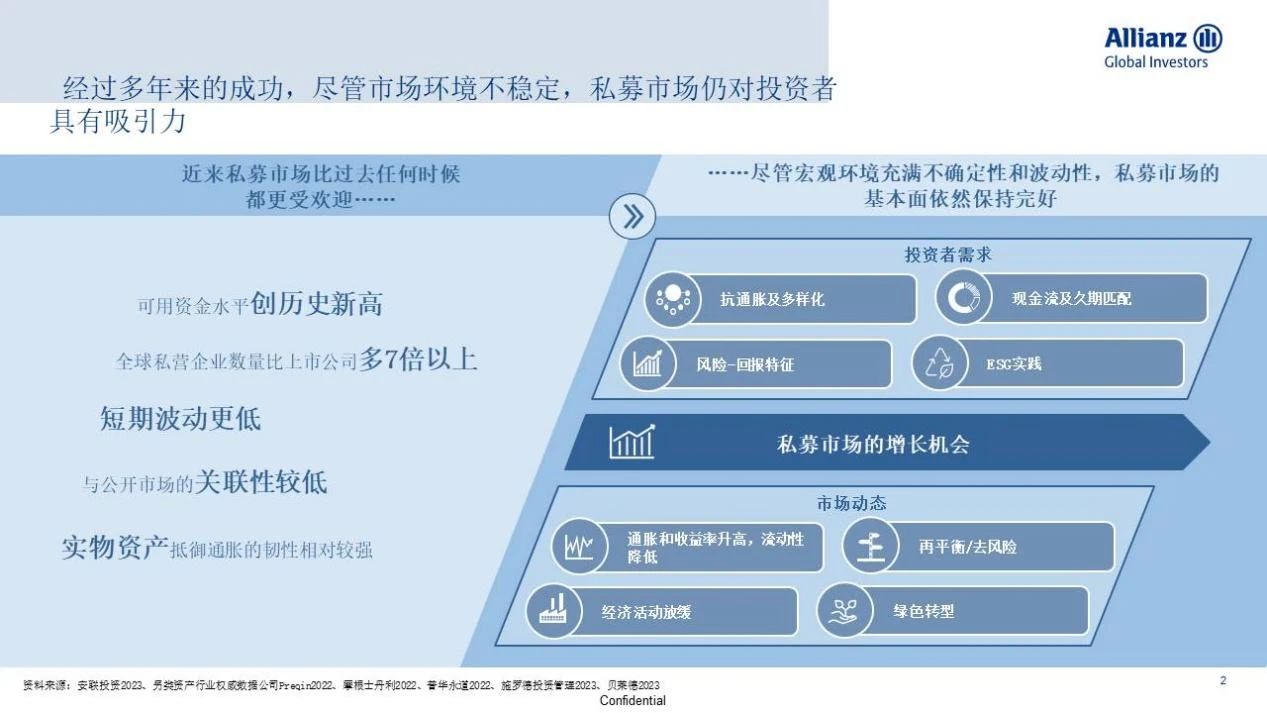

正如大多数人所知,最近私募市场投资比以往任何时候都受欢迎,可用资金量创历史纪录,这是必然结果,原因如下:

-

全球范围内私营企业的数量是上市公司的7倍;

-

私募市场投资的短期波动性更低,在市场不确定时特别有吸引力;

-

其与公开市场的相关性低,为投资者带来了分散投资的巨大好处;

-

而且实物资产能够相对更好抵御通货膨胀,因此近期广受世界各地投资者青睐。

尽管最近宏观环境充满不确定性和波动,但私募市场基本面仍然完好。不管目前市场动态如何,投资者需求发生怎样变化,我们预计私募市场仍有很多增长机会。

目前,全球第三方投资者的需求是由几个长期主题支撑的。只有考察好这些主题及其影响作出投资决定,才能最终推动收益增长。我们认为,主要有以下几个主题:

-

宏观经济背景的变化,主要以加剧波动的通货膨胀和利率为代表;

-

气候变化和旨在解决最紧迫的可持续性问题的全球金融运动;

-

地缘政治特征从传统的全球化转向慢全球化或区域化,甚至是去全球化等不同路径。

这些长期主题及其影响转化为投资机会,我们目前看到机会存在于以下领域:私募信贷、基础设施项目资本结构,以及普通合伙人主导的二级市场交易和跟投,这一切都基于旨在实现可持续性的总体长期趋势。

二、亚洲和亚洲私募市场的主要新趋势和模式

以上是从全球行业的角度进行介绍,现在重点讲讲亚洲和亚洲私募市场的主要新趋势和模式。

在过去几年中,亚洲经历了从传统资本提供者到私募市场的结构性转变,以填补中型企业的资本空白,这些企业最终是推动经济增长的关键贡献者。这种结构性转变是随着2008年以来大银行缩减中型市场业务而开始的。剩下的大型银行更专注于大型借款人。实际上,监管的加强进一步推动银行专注于规模更大、评级更高的公司,使得中型公司面临巨大的融资缺口。

由于公开市场转向大型公司,进一步降低了资本可用性。这清楚地体现为:2003年至2019年,亚洲国内上市公司数量增长14%;同时,2019年国内上市公司平均市值增长到2003年的约4倍。出现这些情况后,亚洲中型公司的巨大资金缺口正是私募市场投资的机会所在。

首先是亚洲私募基金的增长。从2003年到2019年,亚洲的资产管理规模增长了约51倍,同期亚洲在全球资产管理中的份额从4%左右增加到28%左右。随着这一发展,私募股权公司日益成为资产的长期持有者。

其次,私募股权投资填补了资本缺口,而私募信贷紧随其后。亚洲私募信贷经历了借款人需求的增加(从2016年到2019年,资产管理规模在短短3年内翻了一番)。同时,全球投资者开始增加对亚洲私募信贷的配置,最终使得亚洲私募信贷市场的增长逐渐赶上私募股权市场的增长。

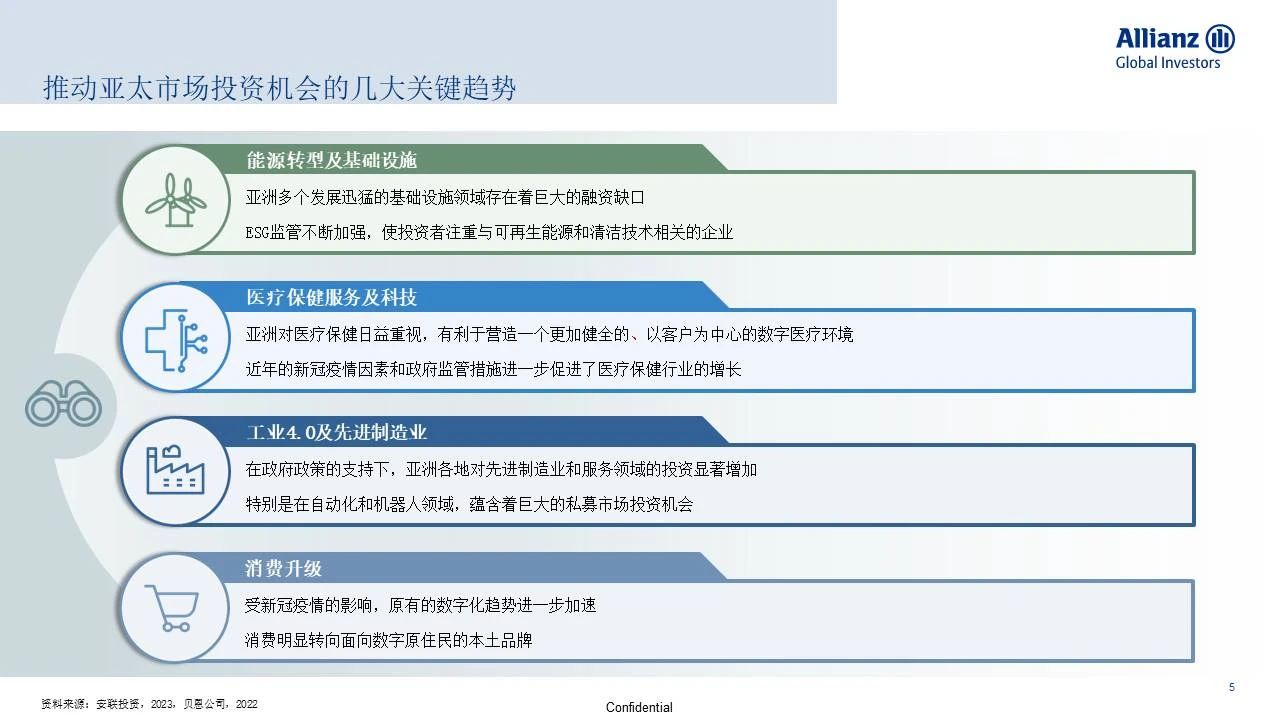

除了亚洲转向私募市场投资的总体趋势外,还有四个长期趋势主题,推动了经济增长以及投资机会增长,特别是私募市场领域。

第一个关键趋势是去碳化和能源转型,其机会来自于:

-

亚洲多个快速增长的基础设施部门存在着巨大的融资缺口,而这些部门渗透率不高;

-

整个地区的ESG法规越来越多,投资者对提供可再生能源和清洁技术相关产品和服务的公司产生了极大的关注。

第二个是医疗服务和技术,其机会来自于:

-

亚洲地区对医疗保健的关注度和消费意愿不断提高,推动了增长,特别是在建立健全以消费者为中心的数字健康环境方面;

-

疫情影响和政府法规进一步支持该市场的增长。

第三个是工业4.0和先进制造业,其机会来自于:

-

在政府政策的支持下,亚洲各地对先进制造业和服务业投资大幅增加;

-

特别是在自动化和机器人领域,有大量私募市场投资机会。

第四个是消费者升级,其机会来自于:

-

亚洲国家强劲的数字化趋势,在被疫情暂时中断后进一步加快;

-

转向目标客户为数字原住民的国内和本土品牌。

三、安联致力于扩大其私募市场业务,投资于经济发展几大关键趋势

安联坚定地致力于扩大其在私募市场的布局,投资于经济发展的主要趋势,并在亚洲私募市场看到了快速增长的机会,这些市场上能发现公开市场上所缺乏的、快速增长的初创公司。

亚洲私募市场的资产管理规模预计将以15%的年复合增长率增长,到2026年达到约2.25万亿美元。基于这些快速增长预期,安联将继续扩大在该地区的投资布局,帮助其转变经济结构。

凭借资产管理规模超过880亿欧元的私募市场平台,安联正在成长为全球私募市场的重要参与者,为世界各地的客户提供越来越多的选择。安联业绩卓著,从2004年开始投资亚洲的私募股权基金,从2008年开始投资中国的私募股权基金。安联的亚太私募市场投资组合目前已达到69亿欧元的资产管理规模,其中39亿欧元投资于中国的私募股权和风险投资基金。

安联重点投资于长期增长主题,包括中国的去碳化和能源转型、医疗保健服务和技术、工业4.0和本地数字消费品牌。

此外,随着亚洲中型公司的快速增长,安联看到了在该地区扩大私募信贷服务的巨大潜力,利用目前的业务布局,将在亚洲的投资扩大到主要市场趋势上。

四、安联投资对中国市场的承诺

作为一家领先的主动资产管理公司,安联一直将中国视为重要的发展市场。中国不仅能够保持经济持续增长,而且承诺加倍努力实现更公平和可持续的发展,这引起了我们的共鸣。

凭借20年中国资产类别的投资经验和正在建立的在岸业务部门,安联支持本地资产管理行业的发展,特别是中国的养老金制度改革和可持续投资的发展。为此,我们目前正在建立中国在岸投资和商业平台,以更好地帮助全球和本地投资者确定在中国的投资方向。

此外,安联对中国私募市场领域的投资机会抱有坚定信心,并认为这为投资者提供了很好的渠道来参与中国的经济转型和增长。我们非常期待帮助客户在公开和私募市场寻找并利用这些机会。

免责声明

投资涉及风险。投资涉及风险。投资的价值和收入可能会上升也可能下降,投资者可能无法收回全部投资额。投资固定收益工具可能会使投资者面临各种风险,包括但不限于信誉、利率、流动性和灵活性受限风险。经济环境和市场条件的变化可能会影响这些风险,从而对投资价值产生不利影响。在名义利率上升期间,固定收益工具(包括短期固定收益工具的头寸)的价值通常预计会下降。相反,在利率下降期间,这些工具的价值通常预计会上升。流动性风险可能会延迟或阻止账户提款或赎回。过去的业绩并不能预测未来的回报。如果显示过去业绩的货币与投资者所在国家的货币不同,那么投资者应该意识到,由于汇率波动,如果转换为投资者的当地货币,显示的业绩可能会更高或更低。本文所表达的观点和意见为发行公司在发布时的观点和观点,如有更改,恕不另行通知。所使用的数据来自各种来源,在发布时被认为是正确和可靠的。应优先可能已经或将要作出或订立的任何潜在要约或合同的条件。这是一份由安联全球投资者股份有限公司(www.allianzgi.com)发布的营销通信,该公司是一家在德国注册成立的有限责任投资公司,注册办事处位于法兰克福Bockenheimer Landstrasse 42-44,60323,在法兰克福当地法院注册,注册号为HRB 9340,由Bundesanstalt für Finanzdienstleistungsaufsicht(www.bafin.de)授权。投资者权利摘要有英文、法文、德文、意大利文和西班牙文版本,网址为https://regulatory.allianzgi.com/en/investors-rights复制、出版或不允许传输内容,无论其形式如何;但经安联全球投资者股份有限公司明确许可的情况除外。

此处包含的声明可能包括基于管理层当前观点和假设的未来预期声明和其他前瞻性声明,这些声明涉及已知和未知的风险和不确定性,可能导致实际结果、绩效或事件与此类声明中明示或暗示的结果、绩效和事件存在重大差异。我们没有义务更新任何前瞻性声明。

该文件已在仅在特定活动中提交的基础上获得批准,并适用于活动范围。如果没有,请联系合规团队。

![]()

As most of you know, private markets investment has been more popular than ever recently, which is well reflected in the record level of available funding - and this for good reason, as

- There are 7x more private than listed companies globally.

- Private Markets Investments have a reduced short-term volatility, which makes them particularly attractive in times of uncertainty in the market.

- There is a low correlation to public markets leading to substantial diversification benefits for investors.And real assets are relatively resilient to inflation, which has made them especially attractive for investors around the world in recent times.

Despite the uncertain and volatile macro environment in recent times, the fundamentals for private markets remain intact.

Notwithstanding current market dynamics and with changing investor demands, we expect there many growth opportunities in private markets.

Currently, global 3rd party investor demand is underpinned by several long-term themes. Making investment decisions in consideration of these themes and their implications is what can ultimately drive growth. We see the main themes in:

- The changing macroeconomic backdrop represented by increasingly volatile inflation and interest rates.

- Climate Change and the movement towards global finance tackling the most pressing sustainability issues.

- Geopolitical shifts away from classical globalization to different further approaches like slowbalization / regionalization or even deglobalization.

These long-term themes and their implications translate into investment opportunities, which we currently see especially in private credit, infrastructure across the capital structure, as well as GP led secondaries and co-investments - this all being underpinned by the general long-term trend towards sustainability.

Having started off with a global industry perspective, I would now like to place the focus on Asia and the predominant new trends and patterns in its private markets.

In the last years, Asia has experienced a structural shift from traditional providers of capital to private markets in order to fill the capital void for middle market corporates, which are ultimately key contributors to driving economic growth.

This structural shift started with the retrenchment of large banks from the middle market since 2008.

With the remaining larger banks focusing rather on larger borrowers. In fact, increased regulation further pushed banks to focus on larger, higher-rated companies, a substantial financing gap opened up for middle market companies.

This decline in capital availability has been further reinforced by Public Markets shifting towards larger companies, which is clearly visible in the 14% increase in the number of listed domestic companies in Asia from 2003 to 2019, as well as the ~4x higher average market cap of listed domestic companies (in 2019 vs. 2003).

The substantial capital gap for Asian middle market companies left in the wake of these developments is exactly where the opportunities for private markets investments opened up.

What followed first was growth in Asia Private Equity with AUM in Asia increasing ~51x from 2003 to 2019 and Asia's share of global AUM increasing from ~4% to ~28% over the same period. With this development Private equity firms have increasingly become longer-term holders of assets.

After Private Equity filling the capital gap, Private Credit followed, with Asia private credit experiencing increasing demand from borrowers (AUM doubled in just 3 years from 2016 to 2019). At the same time global Investors begin increasing their allocations to Asia private credit, ultimately leading to the Asia private credit market growth slowly catching up with the growth of the private equity market.

Apart from the general trend toward private markets investments in Asia, there are four several long-term trend topics that drive economic growth as well as investment opportunities, especially in the private markets sector.

The first of these four is Decarbonization & Energy Transition, which brings opportunity in terms of

•Significant financing gaps across multiple fast-growing infrastructure sectors in Asia that are currently under-penetrated, as well as

•Increasing ESG regulation across the region which has created a significant investor focus on companies with products and services linked to renewable energies and clean technologies.

The second key trend is Healthcare services & technology. Here opportunities derive from

•Increasing focus and willingness to spend on healthcare across Asia, which is fueling growth, especially in building a more robust consumer-centric digital health environment.

•The recent pandemic and government regulations further supporting growth in this market.

The third key trend is Industry 4.0 and advanced manufacturing, as

•Investment in advanced manufacturing and services has risen significantly across Asia supported by government policy, and

•Particularly in around areas of automation and robotics, there are significant Private Markets investment opportunities.

Lastly, many opportunities lie in what we call the Consumer Upgrade, which derives from

•The trend toward digitalization, already strong in Asian countries, having further accelerated following disruptions linked to the pandemic, as well as

•a substantial shift toward domestic and home-grown brands targeting digital natives.

AllianzGI is strongly committed to growing our private markets footprint and investing in the key trends for economic development.

We see rapid growth opportunities in Asian Private Markets, which provide access to innovative and fast-growing companies not available on the public market.

These rapid growth expectations are reflected in the expectation of Private Markets AuM in Asia growing at a 15% CAGR to ca.USD 2.25 trillion by 2026.

Acting on these growth expectations, AllianzGI continues to grow its investment footprint in the region, helping to transform the economic structure.

With a private markets platform of over EUR 88bn in AuM, AllianzGI is currently establishing itself as a global key private markets player, with an ever-increasing suite of optionality for our clients all around the world.

We bring with us an extensive track record having started investing in Private Equity funds across Asia since 2004 and in China since 2008. AllianzGI's Asia Pacific Private Markets portfolio now amounts to €6.9bn in AuM with €3.9bn invested into Chinese Private Equity and venture capital funds.

Our focus lies on Investing into long term growth themes including China's Decarbonization and energy transition, healthcare-services & -technology, industry 4.0 and further development of local digital consumer brands.

Furthermore, with the rapid growth of Asian mid-market companies, AllianzGI sees significant potential to expand its Private credit offering in the region, as we see the opportunity to leverage our current footprint to expand our investment in Asia into key market trends.

As a leading active asset manager, AllianzGI has always regarded China as a key growth market. Aside from its continued economic success, the commitments to doubling down on efforts towards a more equitable and sustainable development very much resonate with us.

With 20 years of experience investing in Chinese asset classes and on-going onshore business units building up, we're here to support the evolution of the local asset management industry, particularly dedicated to China's pension scheme reform and the development of a sustainable investing.

For this, we are currently building up our China onshore investment and business platform to better help global and local investors to navigate investment in China.

In addition, AllianzGI also has strong conviction in investment opportunities in the Chinese private market universe, which we believe offers a great channel for investors to get access to the economic transformation and growth of China.

We are very much looking forward to helping our clients to identify and access to these opportunities across both the public and private sector.

文字整理:周倩

责任编辑:张逸君